Key Takeaways

- Loans can be financial catalysts if planned well, but they can also lead to financial stress without proper planning.

- A financial plan ensures you can manage EMIs comfortably, align the loan with your goals, and protect against risks.

- Key considerations: repayment capacity, interest rates, loan term, and emergency funds.

- Practical tips include assessing need, shopping for the best terms, and aligning loans with asset life.

- Always integrate loans into your overall financial plan to achieve long-term stability.

The Importance of a Financial Plan Before Taking a Loan – Loans can be lifesavers. They help us fulfill dreams—like buying a house, expanding a business, or pursuing higher education. But they can also become a nightmare if taken without proper planning. Imagine buying your dream car, only to realize the monthly EMI leaves you short on essentials.

Planning isn’t optional; it’s essential. Let’s dive into why creating a financial plan before taking a loan can make all the difference.

Loans are tools, and like any tool, they work best when used wisely. A well-structured loan can help you achieve significant milestones—owning your dream home, growing a business, or funding your child’s education. However, loans should never be taken impulsively.

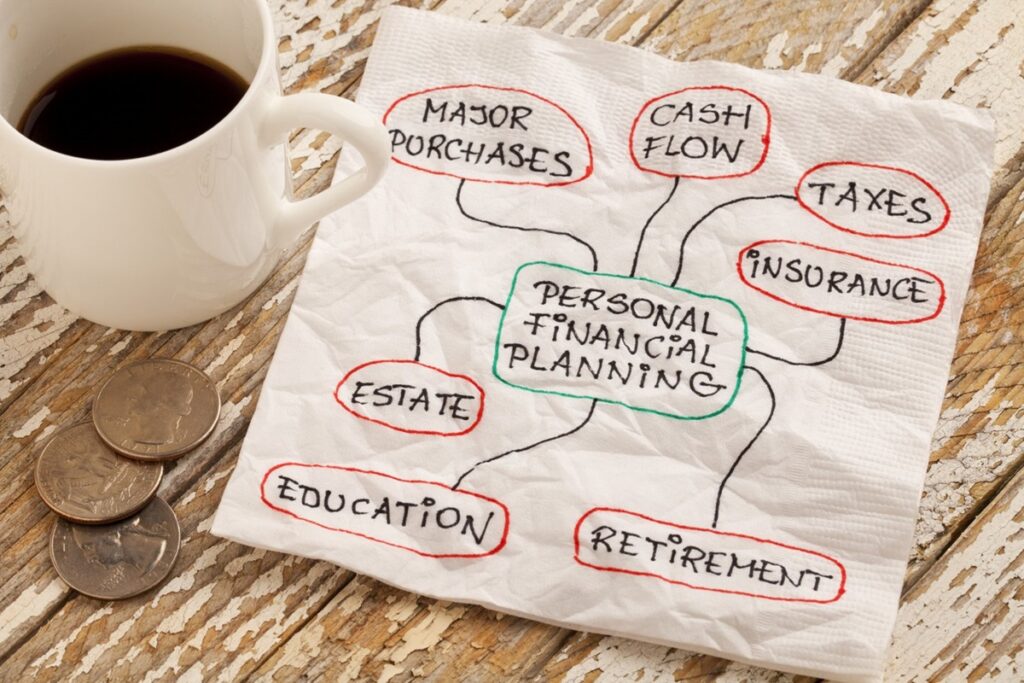

Understanding the Ripple Effect on Your Finances – Taking a loan isn’t just about the money you borrow. It impacts various aspects of your financial life!

1. Cash Outflows and Budget Impact – Loans come with EMIs (Equated Monthly Installments). These regular outflows can strain your budget if not planned well. Before committing, ensure your monthly expenses, savings, and loan repayments can coexist peacefully.

2. Impact on Net Worth – Initially, loans reduce your net worth because they add to your liabilities. Over time, as you repay the loan and your asset appreciates (e.g., a home or business), your net worth can increase.

3. Managing Risks – Life is unpredictable. Job loss, illness, or unexpected emergencies can make loans burdensome. A financial plan includes risk mitigation strategies like emergency funds or insurance to protect against these uncertainties.

Did you find these tips helpful? Subscribe to our newsletter for more financial advice tailored to your needs!

Smart Borrowing: Questions to Ask Yourself – Before signing any loan agreement, reflect on these key questions:

1. Do I Need This Loan?

Ask yourself if the loan is genuinely essential. Can you save and delay gratification instead? For instance, Anita in Chennai expanded her boutique with a loan but didn’t plan for emergencies. When COVID struck, she struggled with repayments. A financial plan could have included an emergency fund, saving her from financial distress.

2. Can I Afford to Repay It?

Calculate your repayment capacity. Look at your income, expenses, and financial stability. Use online EMI calculators to get a clear picture.

Ensure your EMI doesn’t exceed 30% of your monthly income.

3. Are the Interest Rates and Terms Favorable?

Shop around for the best rates and terms. Don’t settle for the first offer. Read the fine print, especially regarding penalties for early repayment or default.

Aligning Loans with Long-Term Goals – A loan isn’t a standalone decision; it must align with your financial goals!

1. Match the Loan Term to the Asset’s Life – Ensure the loan term doesn’t exceed the useful life of the asset. For example, a car loan should ideally be repaid before the car starts requiring costly maintenance.

2. Avoid Overextending Into Retirement – Don’t let loans spill into your retirement years when your income might reduce. Instead, aim to clear major debts well before retirement.

Practical Tips for Smart Loan Planning:

- Assess Your Emergency Fund: Before taking a loan, ensure you have at least 3–6 months of living expenses saved.

- Budget for EMIs: Adjust your budget to accommodate EMIs without cutting into essentials or savings.

- Use Online Tools: Use EMI calculators to estimate repayments.

- Take Insurance: Secure your loan with insurance to cover repayments in case of emergencies.

- Avoid Impulse Decisions: Always sleep on a loan decision. Hasty borrowing can lead to long-term stress.

Taking a loan isn’t just a financial decision—it’s a life decision. Without a plan, it can lead to financial strain. With a plan, it can be the stepping stone to your dreams.

Always integrate loans into your broader financial strategy. Ensure they align with your goals, assess repayment capacity, and prepare for uncertainties. A loan should work for you, not against you.

We’d love to hear your thoughts! Have you ever faced challenges with loan repayments? What strategies helped you manage them? Share your experiences in the comments below.